Patients gave the esteemed Mayo Clinic four out of five stars in the new Medicare hospital rating system.

Patients gave the esteemed Mayo Clinic four out of five stars in the new Medicare hospital rating system. Many of the nation's leading hospitals received middling ratings, while comparatively obscure local hospitals and others that specialized in lucrative surgeries frequently received the most stars.

Evaluating hospitals is becoming increasingly important as more insurance plans offer patients limited choices. Medicare already uses stars to rate nursing homes, dialysis centers and private Medicare Advantage insurance plans.

While Medicare publishes more than 100 quality measures about hospitals on its Hospital Compare website, many are hard to decipher. There is little evidence consumers use the site very much.

Many in the hospital industry fear Medicare's five-star scale won't accurately reflect quality and may place too much weight on patient reviews, which are just one measurement of hospital quality. Medicare also reports the results of hospital care, such as how many people died or got infections during their stay, but those are not yet assigned stars.

"We want to expand this to other areas like clinical outcomes and safety over time, but we thought patient experience would be very understandable to consumers so we started there," Dr. Patrick Conway, chief medical officer for the Centers for Medicare & Medicaid Services, or CMS, said.

Related: Hospitals ask patients to pay upfront

Medicare's new summary star rating, posted Thursday on its Hospital Compare website, is based on 11 facets of patient experience, including how well doctors and nurses communicated, how well patients believed their pain was addressed, and whether they would recommend the hospital to others. Hospitals collect the reviews by randomly surveying adult patients -- not just those on Medicare — after they leave the facility.

In assigning stars, Medicare compared hospital against each other, essentially grading on a curve. It noted on its Hospital Compare website that "a 1-star rating does not mean that you will receive poor care from a hospital" and that "we suggest that you use the star rating along with other quality information when making decisions about choosing a hospital."

The American Hospital Association also issued a caution to patients, saying "There's a risk of oversimplifying the complexity of quality care or misinterpreting what is important to a particular patient, especially since patients seek care for many different reasons."

Nationally, Medicare awarded the top rating of five stars to 251 hospitals, about 7% of all the hospitals Medicare judged, a Kaiser Health News analysis found. Many are small specialty hospitals that focus on lucrative elective operations such as spine, heart or knee surgeries. They have traditionally received more positive patient reviews than have general hospitals, where a diversity of sicknesses and chaotic emergency rooms make it more likely patients will have a bad experience.

Related: Hospitals face major government crackdown for injuring patients

A few five-star hospitals are part of well-respected systems, such as the Mayo Clinic's hospitals in Phoenix, Jacksonville, Fla. and New Prague, Minn. Mayo's flagship hospital in Rochester, Minn., received four stars.

Medicare awarded three stars to some of the nation's most esteemed hospitals, including Cedars-Sinai Medical Center in Los Angeles, NewYork-Presbyterian Hospital in Manhattan and Northwestern Memorial Hospital in Chicago. The government gave its lowest rating of one star to 101 hospitals, or 3%.

On average, hospitals scored highest in Maine, Nebraska, South Dakota, Wisconsin and Minnesota, KHN found. Thirty four states had zero one-star hospitals.

Hospitals in Maryland, Nevada, New York, New Jersey, Florida, California and the District of Columbia scored lowest on average. Thirteen states and the District of Columbia did not have a single five-star hospital.

In total, Medicare assigned star ratings to 3,553 hospitals based on the experiences of patients who were admitted between July 2013 and June 2014.

Related: Even insured consumers get hit with surprisingly large medical bills

While the stars are new, the results of the patient satisfaction surveys are not. They are presented on Hospital Compare as percentages, such as the share of patients who said their room was always quiet at night. Often, hospitals can differ by just a percentage point or two, and until now Medicare did not indicate what differences it considered significant. Medicare also uses patient reviews in doling out bonuses or penalties to hospitals based on their quality each year.

Some groups that do their own efforts to evaluate hospital quality questioned whether the new star ratings would help consumers. Evan Marks, an executive at Healthgrades, which publishes lists of top hospitals, said it was unlikely consumers would flock to the government's rating without an aggressive effort to make them aware of it.

Jean Chenoweth, an executive at Truven Health Analytics, which also publishes its own list of top hospitals, said she feared hospital marketing departments would oversell the meaning of the stars.

"It would be very unfortunate and misleading if a hospital marketing department could claim to be a CMS five-star hospital and fail to mention it only reflected a patients' perception of care," she said.

How to find a hospital's star rating:

Go to Hospital Compare's web site

Type in your zip code and/or hospital name

Select up to three hospitals by clicking the "Add to compare" button

Under Compare Hospitals title, click "Survey of patients' experiences" tab

Scroll down to the star rating

Kaiser Health News (KHN) is a national health policy news service. It is an editorially independent program of the Henry J. Kaiser Family Foundation.

CNNMoney (New York) April 16, 2015: 8:25 PM ET

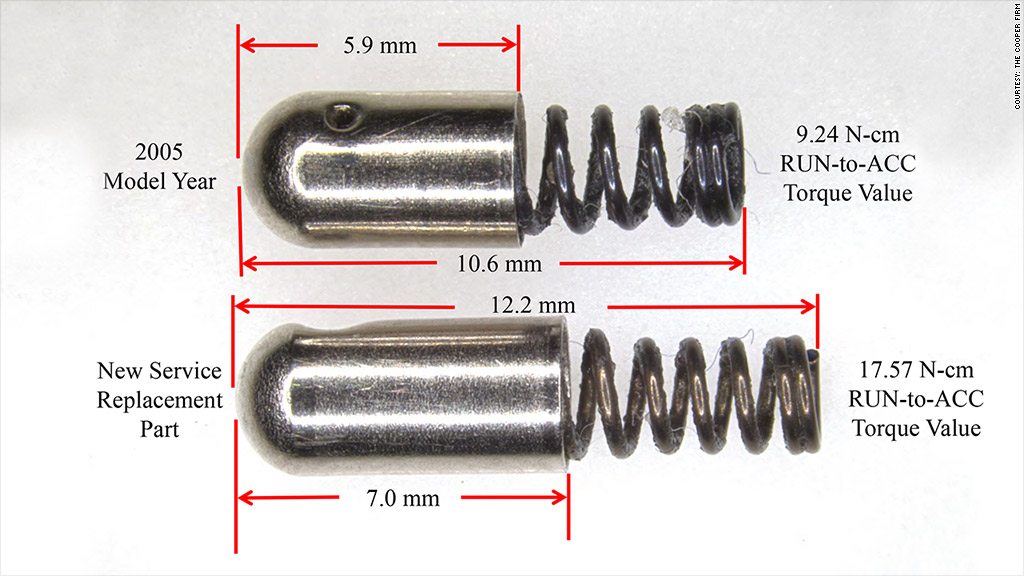

The old and new version of the tiny part that is at the center of the GM recall.

The old and new version of the tiny part that is at the center of the GM recall.