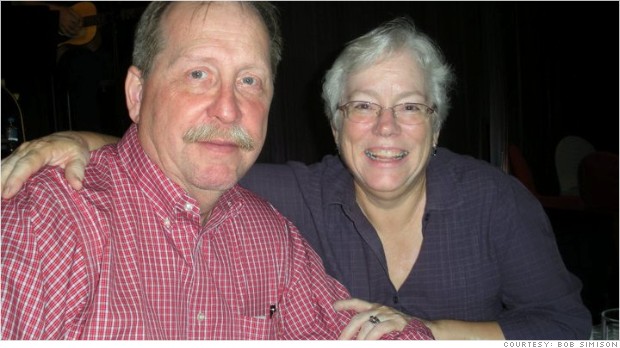

Bob Simison, a U.S. expat in Australia (with his wife, Sarah) says it takes him 40 hours to prepare his taxes each year.

HONG KONG (CNNMoney)

Unlike citizens of most other countries, Americans are legally obligated to file U.S. taxes each year, even if they are living and earning income overseas.

Problem is most expats are also required to pay taxes in their country of residence. This means two huge piles of paperwork, two sets of deadlines and one giant struggle to keep pace with a complex mess of ever-changing regulations.

"As soon as I moved overseas, that's when things got very complicated," said James Rosenberg, an IT professional who owns a business in South Korea.

While living in the U.S., the Iowa native was able to prepare his returns using TurboTax. That's no longer the case -- Rosenberg's taxes are now so complicated he has been forced to hire an accountant.

Rosenberg isn't alone. American expats told CNNMoney they are overwhelmed by filing requirements, and many are struggling to find accurate and up-to-date information. Some said they were given conflicting instructions by the IRS, or received bad advice from independent tax advisers.

Some expats said they are so exasperated by the current system that they are considering a move back to the U.S. -- or in other cases, starting the process to renounce their American citizenship.

Related story: Americans turn in passports as new tax law hits

Divesh Agarwal, an American living in India, said he has not been able to find a local accountant who knows enough about American tax law to handle his return. Agarwal said he spends hours scouring the Internet for tax tips because he doesn't want to spend thousands of dollars on an accountant.

"I don't see any improvement, I only see it getting worse," Agarwal said.

Americans are generally exempt from paying tax on their first $95,000 in foreign income, but they are still required to file a return. And there are a number of things aside from salary that the IRS considers income, such as housing allowances or school stipends -- benefits that companies often use to entice Americans to move abroad.

Air Force veteran Gordon Peters found this out the hard way. None of the tax advisers he consulted before taking a gig in Beijing earlier this year mentioned that he would be taxed on benefits.

Peters had received a housing and education benefit as part of his compensation package as a medical director. The unexpected tax burden, he said, has just about erased his disposable income.

"I make a fairly nice wage, but we end up having to count pennies at the end of the month," Peters said.

Related story: Banks lock out Americans over new tax law

Sometimes, even the IRS is a source of confusion for expats.

Bob Simison, who has lived in Australia for nearly a decade, said he was spending 40 hours a year to prepare his returns -- even though his income wasn't high enough to owe anything to Uncle Sam.

Then the IRS sent him a bill for thousands of dollars in unpaid taxes.

Simison believed the IRS had made a mistake, but was unable to find an accountant in Australia with the knowledge to help. So he contacted the agency himself. Simison said the process was "atrocious" -- and he was given conflicting instructions, and then an even larger bill, before the dispute was resolved a year later with help from a U.S. senator.

"The process is far more complex than it needs to be," Simison said. "We're just normal people. We don't have big business interests, no huge savings accounts, no heavy investments or anything."

In recent years, the burden has become even greater as new laws designed to crack down on overseas tax cheats have pushed even more paperwork on expats.

Related story: Branson: My island life isn't a tax dodge

When asked by CNNMoney to comment about the tax troubles that expats face, the IRS responded with a link to information about paying taxes while abroad.

The burden is leaving some expats with a tough decision to make -- and advocacy groups are quick to point out an increase in Americans who chose to renounce their citizenship.

Others, like Peters, are considering giving up their careers abroad in order to return to the U.S. to reduce their tax pains.

"If it continues like this, I'm going to have to say that it was a great experiment, but it can't continue," he said. "The tax law makes it very unattractive for Americans to go abroad." ![]()

First Published: October 30, 2013: 10:04 PM ET