NEW YORK (CNNMoney)

The short answer is yes. Although there's no official benchmark for the appropriate margin of safety, I think most advisers would say that an 80% to 90% probability of success is about right for most people.

Fall below 80% and you could find yourself short on money later in retirement. Shoot for a chance of success higher than 90%, on the other hand, and you may end up sitting on a big pile of savings very late in life.

That may not sound like a bad thing, but it could mean that you lived more frugally than you had to during your career and stinted more than necessary in retirement. In other words, you might have been able to spend more freely and enjoy yourself more during both your working and retirement years.

That said, there are some caveats to the probability numbers that advisers generate with their retirement planning software -- or that you can get on your own from calculators like those in my Retirement Toolbox. One major caution: your chances of success can drop pretty dramatically if your nest egg's value takes a sharp dive. Given the stock market's recent volatility, that's a possibility to keep in mind.

Before I get into the nuances surrounding these projections, however, I'm going to briefly explain Monte Carlo simulations.

Related: Investing smart in a rocky market

Named after the famed casino in Monaco, Monte Carlo simulations attempt to incorporate the variability of real life into financial projections. The adviser plugs in such information as how much you saved, how much you're saving on an ongoing basis (if you're still working), how you invest that money, when you plan to retire, how much you plan to withdraw from your savings once you retire and how long you estimate you'll need your savings to last.

Once all this information is entered, the software or calculator creates hundreds or even thousands of different scenarios, or pathways, that your nest egg could take. Some reflect conditions in which the market performs well and inflation remains tame; others factor in a market crash and higher inflation. In some of these scenarios, you run out of money early in retirement. In others, you may never run out. But in most, the length of time your dough lasts falls between these extremes.

So, for example, if you're 55, plan to retire at 65 and want your savings to support you at least until age 95, you would plug in all the information about your savings, investments and projected spending, the software would crunch the numbers and...voila! It will tell you the probability that your savings will sustain you to 95.

If your savings isn't able to generate the income you need to support your spending until age 95 in 15% of the scenarios the software runs, then your probability of success is 85%. If you run short in 30% of the scenarios respectively, your probability of success is 70%.

Now for those nuances.

The results you get when you run Monte Carlo simulations seem very exact, but remember: They're long-term projections based on the assumptions you plug in. So they're not as precise as they seem. No one really knows how the markets will perform over the next 10, 20 or 30 years. Or what inflation will do. Or whether you'll be able to stick to your savings plan or face large unanticipated expenses in retirement (such as larger-than-expected health care costs).

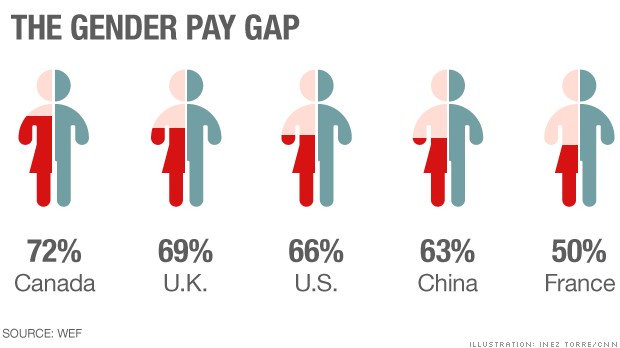

Related: Why women are losing the retirement savings game

So you want to try to keep your assumptions as reasonable as possible -- that is, no 10% or 15% annual returns or overly aggressive investment asset mixes, no unrealistic savings rates or a retirement budget that not even an ascetic could stick to. And you should think of the percentage chance of success more as a possibility than a guarantee.

You can see how your chances of success might rise or fall if you (or the markets) behave differently. Save more during your career, and you'll see the probabilities rise. Likewise, if you tone down spending in retirement.

Keep in mind too that the percentage probability of success that everyone focuses on tells you only whether you'll be able to draw a given amount of income up to whatever age you plug in. It doesn't tell you how much of your savings will be left at that point.

So you may have an 85% chance of success and have $1 of savings left at age 95 in some scenarios. In others, you could have an 85% chance of success and still have nearly as much money as you started with at retirement -- or more.

That's important to know because you're probably better off spending more earlier in retirement than ending up at an advanced age with a huge savings balance, unless you're really set on leaving a big stash to your heirs.

You need to be especially careful if your portfolio's value takes a large hit, especially just before or early in retirement. For example, a 65-year-old who plans to follow the 4% rule -- that is withdraw 4% of his nest egg's value initially and adjust that amount annually for inflation -- could easily see the chances of his portfolio lasting 30 years drop by 25%, if his portfolio took a 20% dive on the eve of retirement. The combination of the investment loss and withdrawals would so deplete the value of the portfolio that it can't recover sufficiently even when the market eventually turns around.

Related: The 3 biggest risks every retirement saver should know about

Given how much your probability of success can fluctuate for any number of reasons, you should have your adviser rerun the simulations -- or rerun them yourself -- every year or so, using more current information about your age, savings balances and such.

You don't have to alter your plans if your odds of success rise or fall just a bit in a given year. But if you notice that the probability has been trending steadily downward over time -- or has suddenly plunged in the wake of a severe market downturn -- then you want to re-examine what you're doing and make adjustments to get back on track, such as saving more if you're still working or paring your spending for a while if you've already retired.

The key, though, is to create a retirement income plan and manage it over time, so you can make relatively small corrections along the way, rather than letting things slide and then having to deal with a crisis.

So kudos to you for planning in the first place, and for arranging your financial affairs so that, at this point at least, you appear to have an excellent shot at a secure retirement. If you keep monitoring your progress and stand ready to make tweaks when necessary, chances are your prospects will remain that way.

Walter Updegrave is the editor of RealDealRetirement.com. If you have a question on retirement or investing that you would like Walter to answer online, send it to him at walter@realdealretirement.com.

More From RealDealRetirement.com:

Investing smart in a rocky market

How smart an investor are you? Take this quiz

How to build a $1 million IRA

Are you diversifying or di-worse-ifying?

First Published: October 21, 2014: 7:21 PM ET

"Chevy Guy" Rikk Wilde became a viral sensation bumbling his way through a World Series presentation Wednesday night.

"Chevy Guy" Rikk Wilde became a viral sensation bumbling his way through a World Series presentation Wednesday night.

Graduates cheer during the Bowie State University graduation ceremony in May 2013.

Graduates cheer during the Bowie State University graduation ceremony in May 2013.  Apple VP says company quickly fixed iOS bug.

Apple VP says company quickly fixed iOS bug.  A big logo created from pictures of Facebook users worldwide is pictured at a company data center in Sweden.

A big logo created from pictures of Facebook users worldwide is pictured at a company data center in Sweden.

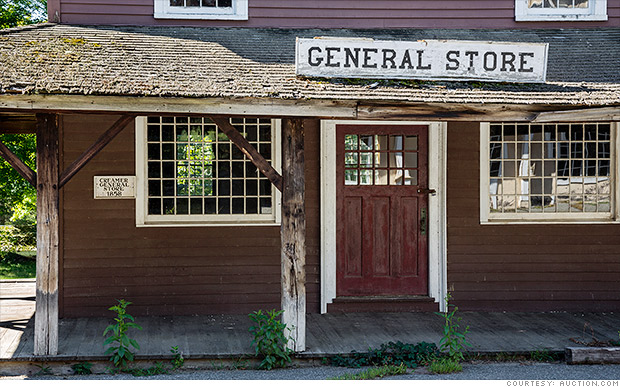

For sale: Up for auction next week is an abandoned Connecticut mill town

For sale: Up for auction next week is an abandoned Connecticut mill town  Town father Emory Johnson called this 1842 mansion home.

Town father Emory Johnson called this 1842 mansion home.  The old stable is topped by a fancy square cupola.

The old stable is topped by a fancy square cupola.  Billy Joel used the chapel in his 1993 video "River of Dreams."

Billy Joel used the chapel in his 1993 video "River of Dreams."  Fine twine for fishing nets was spun in the town mill.

Fine twine for fishing nets was spun in the town mill.  A tavern hosted wedding receptions when former owner, Ray Schmitt, ran Johnsonville.

A tavern hosted wedding receptions when former owner, Ray Schmitt, ran Johnsonville.  Some buildings, like the general store, need work.

Some buildings, like the general store, need work.  Water from the pond powered the old mills.

Water from the pond powered the old mills.

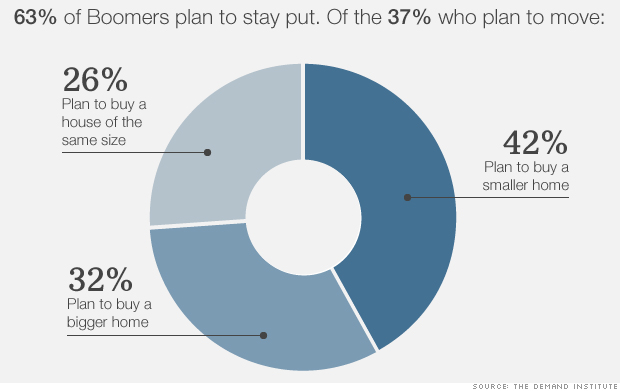

The most common homeowner complaint is that the house is too small.

The most common homeowner complaint is that the house is too small.  Investors aren't thrilled with CEO Jeff Bezos' quarterly losses.

Investors aren't thrilled with CEO Jeff Bezos' quarterly losses.  China is third on HSBC's ranking of best expat destinations.

China is third on HSBC's ranking of best expat destinations.  Conservatives trust Fox News more than other outlets, but liberals don't.

Conservatives trust Fox News more than other outlets, but liberals don't.

Barista Kirstie Ponce showing off her tattoos.

Barista Kirstie Ponce showing off her tattoos.